The best part? You don’t need to work with a Certified Financial Planner (CFP) or other financial expert to figure this number out. This number is unique to you and your lifestyle goals, and calculating it is a simple way to get your financial independence journey off and running.

In the FIRE movement, your target retirement number is known as the FIRE number. “By making work optional, you have more time to spend with loved ones.” “Work culture in the United States essentially forces people to deprioritize the role they play in their families,” says Julien Saunders, who, with his wife Kiersten, runs Rich and Regular, a personal finance brand focused on FIRE resources for the Black community. By calculating the net worth you’d need to retire early and accelerating your savings timeline, you could actually “move the goalposts” and exit the workforce years or decades ahead of schedule. This publication, and others that followed, helped FIRE enthusiasts realize that retirement didn’t have to be confined to a certain age bracket. This guide will get you started with everything you need to know about FIRE: what it is, why it’s controversial, and how you can start using its principles today to achieve financial independence on your terms. Once anchored to a shared goal of retiring as quickly as possible, the movement has evolved more toward cultivating an intentional lifestyle, rewiring the way we think about money, and working toward a better quality of life. The pursuit of financial freedom on your terms is what’s known as the Financial Independence, Retire Early (FIRE) movement - and in recent years, it’s expanded to encompass both saver and spender personal finance styles. “Even if you never ‘make the numbers’, the journey in and of itself is worth the peace of mind that you get in the learning process.” “If you are someone who stresses about money, who came from a past or a childhood where you were taught to stress about money… trying for financial independence is worth it,” says Bernadette Joy, who paid down $300,000 in debt and became work-optional at the age of 37. But all in all, financial freedom is achievable with the right approach and a logical timeline. Thanks to personal finance education on investing, side hustles, and passive income becoming widely available on the internet, money making opportunities are now all around us. Financial independence - often abbreviated to “FI” in personal finance circles - gives you space to cultivate your legacy, contribute to your family and the world, and leave nothing on the table when you reach your final days.įinancial independence is no longer an end-of-life or wealthy lineage phenomenon.

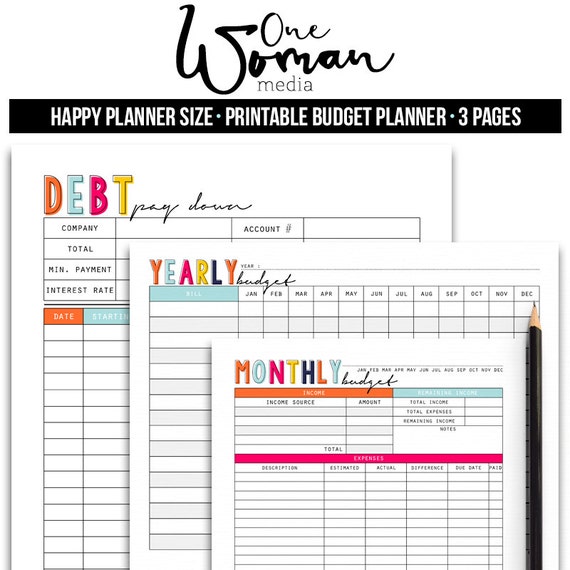

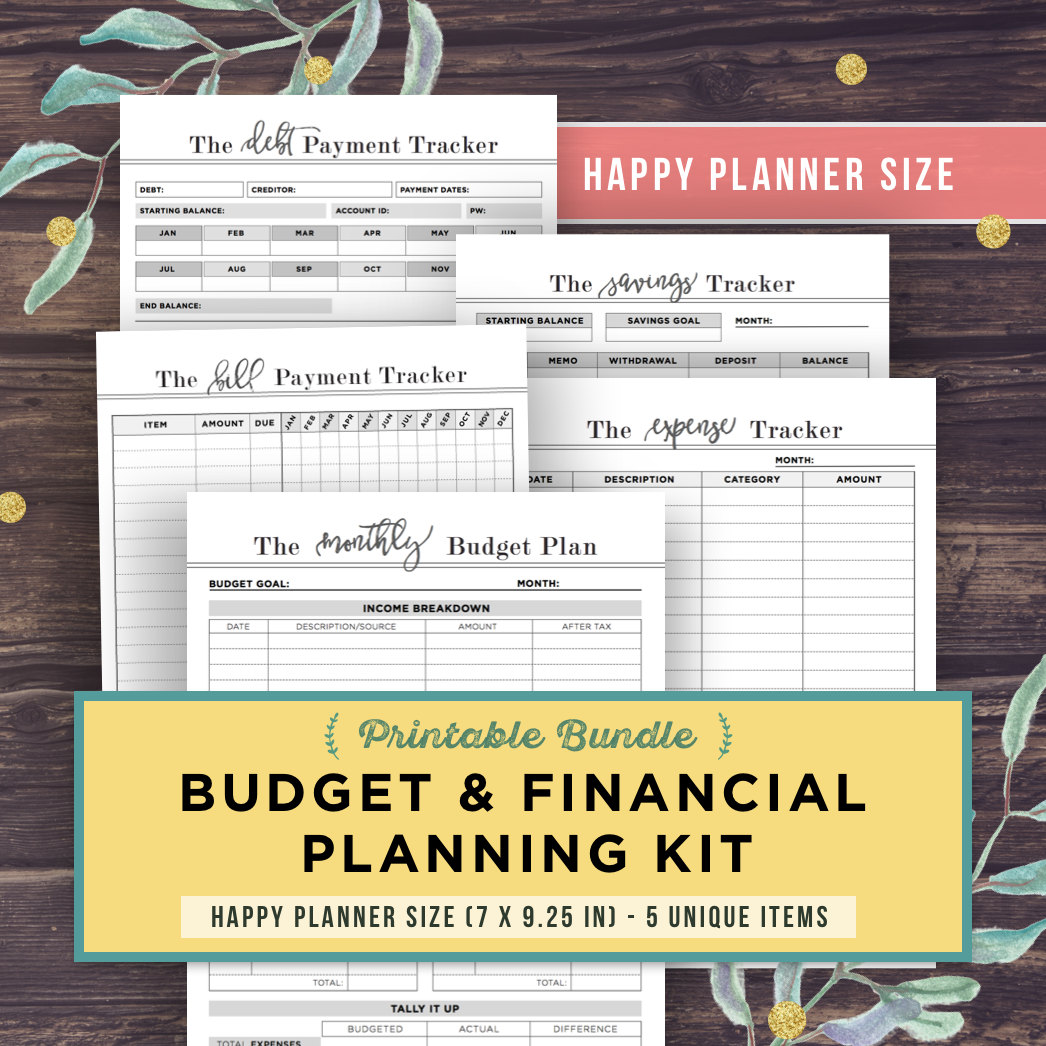

#Happy planner budget planner free

It’s through financial independence: the ability to be work-optional, location-independent, and, most importantly, free to do as you please with your time. But the way out of money stress is not through more wealth.

Money stress is one of the most powerful psychological triggers of our lives. For more information, see How We Make Money.

Some links on this page - clearly marked - may take you to a partner website and may result in us earning a referral commission. We want to help you make more informed decisions.

0 kommentar(er)

0 kommentar(er)